The marketing universe is host to a vast constellation of terminology and metrics.

One of the most important ones?

Customer lifetime value - CLV.

In simple terms, CLV is a measure or indicator of how much a customer is worth to your business for the duration of their relationship with your business.

Some customers may buy something once, others twice, three times, etc, etc.

But some customers might buy stuff periodically every week, month, or year, and these purchases could remain stable and reliable for years.

The latter customers here have higher CLV than the first.

They’re loyal, they enjoy your products and service - something about your business clicks with them. Uncovering high CLV customers is important for targeting marketing and advertising campaigns - you want to retain these customers as they’ll provide more long-term value to your business.

How to Calculate Customer Lifetime Value

A customer lifetime value calculation is fairly hard to generate for newer businesses or startups, as you’ll need some longitudinal data.

The basic customer lifetime value formula is:

CLV = Average Order Value x Purchase Frequency (per year) x Average Customer Lifetime (in years).

The Average Order Value here is straightforward - you’ll need to average the sales you’ve made to that person.

Purchase Frequencyindicates how many times an order is made per year.

Average Customer Lifetimeis not implied literally - it’s a measure of how long your average customer sticks with your brand before they forget about it or move to another.

Here’s a customer lifetime value example:

Out of records of 100 customers, you’ve found that you take an average 10 orders a year valued at £20 per order. Long-term customer data shows that most customers stop using your brand/business after 5 years.

The calculation here is:

CLV = 20 x 10 x 5 = £1000

Each customer has a CLV of £1000. That’s how much value a customer generates for your business over their average relationship. Acquire a customer and on average, they will yield revenue of £1000.

This could be good or bad - CLV alone is actually pretty meaningless.

You need other metrics, namely, Cost to Serve (CTS) and Customer Acquisition Cost (CAC)

Cost to Serve and Customer Acquisition Cost

Cost to Serve (CTS) is a measure of how much it costs to serve your customers. This factors in your overheads in all their totality - production, tax, location, delivery, staff costs, everything.

Customer Acquisition Cost (CAC) measures how much it costs to acquire those customers. This includes marketing and advertising costs.

Let’s take a simplified example:

- Business A has total costs of £1000 a year

- Each customer costs £5 to acquire via marketing

- They have 100 customers in total, each with a CLV of £1000 from an average of 10 orders a year at £20 per order over an average relationship of 5 years

So…

- Each customer has a revenue of £200 per year

- The average relationship is 5 years - the CLV per customer is £1000

- Cost of acquisition is £50

- Cost to serve each customer per year is (£1000 costs/100 customers = £10 per customer or £50 per customer over 5 years)

- Cost to acquire customers = £50 (£5 per customer)

CLV = £1000 - £110 - £5 = £945 after costs.

This is a profitable customer lifetime value model.

After costs, each customer is worth £945 to you per average 5-year relationship.

However, if you were spending a lot more on marketing, for example, this value would come right down.

By calculating CLVs, you can discover how much leverage you have to acquire new customers and how much they’re worth per year over their expected relationship duration.

You can also categorise the types of customers that are worth more to your brand, e.g. you could choose to group customers who yield much higher CLVs for targeted advertising, marketing, and other incentives.

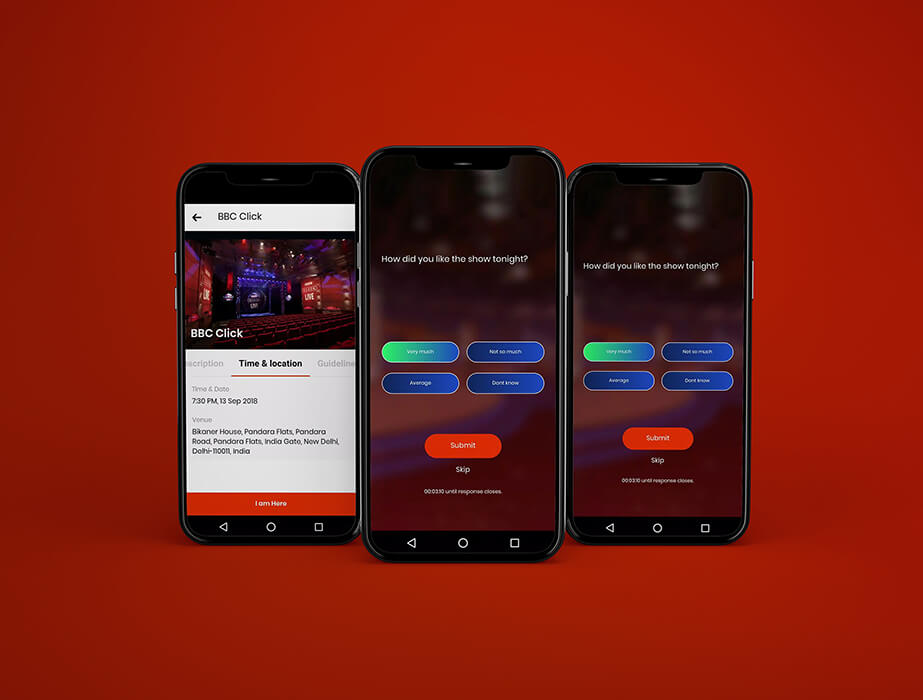

Increase your average CLV, get an app

Apps have the power to transform your CLV, as they:

- Improve customer service

- Increase brand presence

- Improve accessibility

- Gather customer details

And now, getting an app has never been so simple. Studio Store makes acquiring an awesome app as easy as ordering a pizza. Just select a pre-packaged app, and you’ll be up and running in just 2 short weeks. Find your app now.

Liam is Builder.ai’s Head of Performance, with 10+ years’ experience of defining, activating and executing digital marketing campaigns. In his work at internationally recognised agencies like MediaCom and MG OMD, he was client lead for large accounts like DFS, Kenwood & De’Longhi and Boots as well as many SMBs, driving commercial growth through bespoke ecommerce and omni-channel strategies.

Facebook

Facebook X

X LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram RSS

RSS