FinTech

AI-powered fintech software development

Fintech is evolving fast, but security risks and compliance hurdles can hold your business back. At Builder.ai, we help start-ups and SMBs build high-performance, secure fintech software — faster and without tech headaches.

Serving the world's leading brands

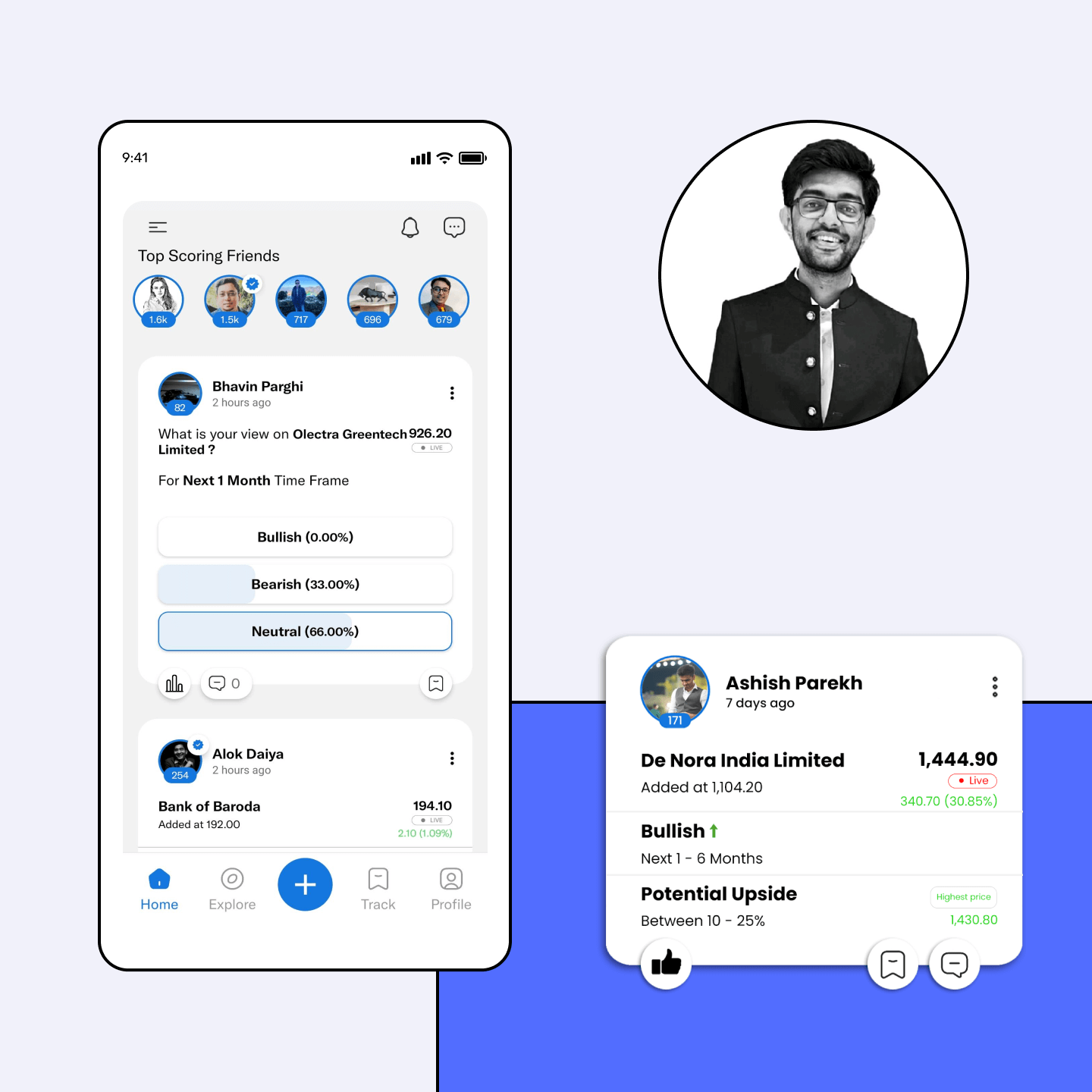

"I would definitely recommend Builder.ai. If you want to bring your idea to life, you need a solid tech partner and Builder.ai has all the capabilities."

Devansh Mehta

Founder at Opigo

Build a disruptive fintech solution

We offer bespoke fintech solutions to bring your vision to life. With us, you can build various fintech solutions from scratch and boost your fintech venture…

Peer-to-peer lending platforms

Insurtech solutions

Payments solutions

Mortgage solutions

Digital banking solutions

Peer-to-peer lending platforms

Skip the middlemen. Build secure lending software that quickly connects borrowers with lenders directly, simplifying the borrowing process. Offer features like real-time credit scoring, automated loan disbursements and built-in compliance to reduce approval times and eliminate inefficiencies.

Insurtech solutions

Scale your insurance venture by offering personalised policies and speed up the claims process with our insurtech software development. With our automated underwriting and risk assessment, and real-time policy adjustments, we ensure a seamless experience for both insurers and policyholders.

Payments solutions

Slow transactions and fraud risks can hinder your business. Whether you're building a checkout experience, subscription model or international payment solution, we’ve got you covered with features such as recurring payments, payment gateway integration, fraud detection and multi-currency transactions to process payments faster and reliably.

Mortgage solutions

Simplify loan origination and processing with our mortgage solutions featuring automated document verification, credit assessment tools, instant loan and real-time application tracking. Whether you’re a lender or a broker, we help optimise your operations.

Digital banking solutions

Modern banking needs more than just a mobile app. We help you launch agile banking solutions with smart account management, instant transactions and personalisation built in—no more clunky legacy systems.

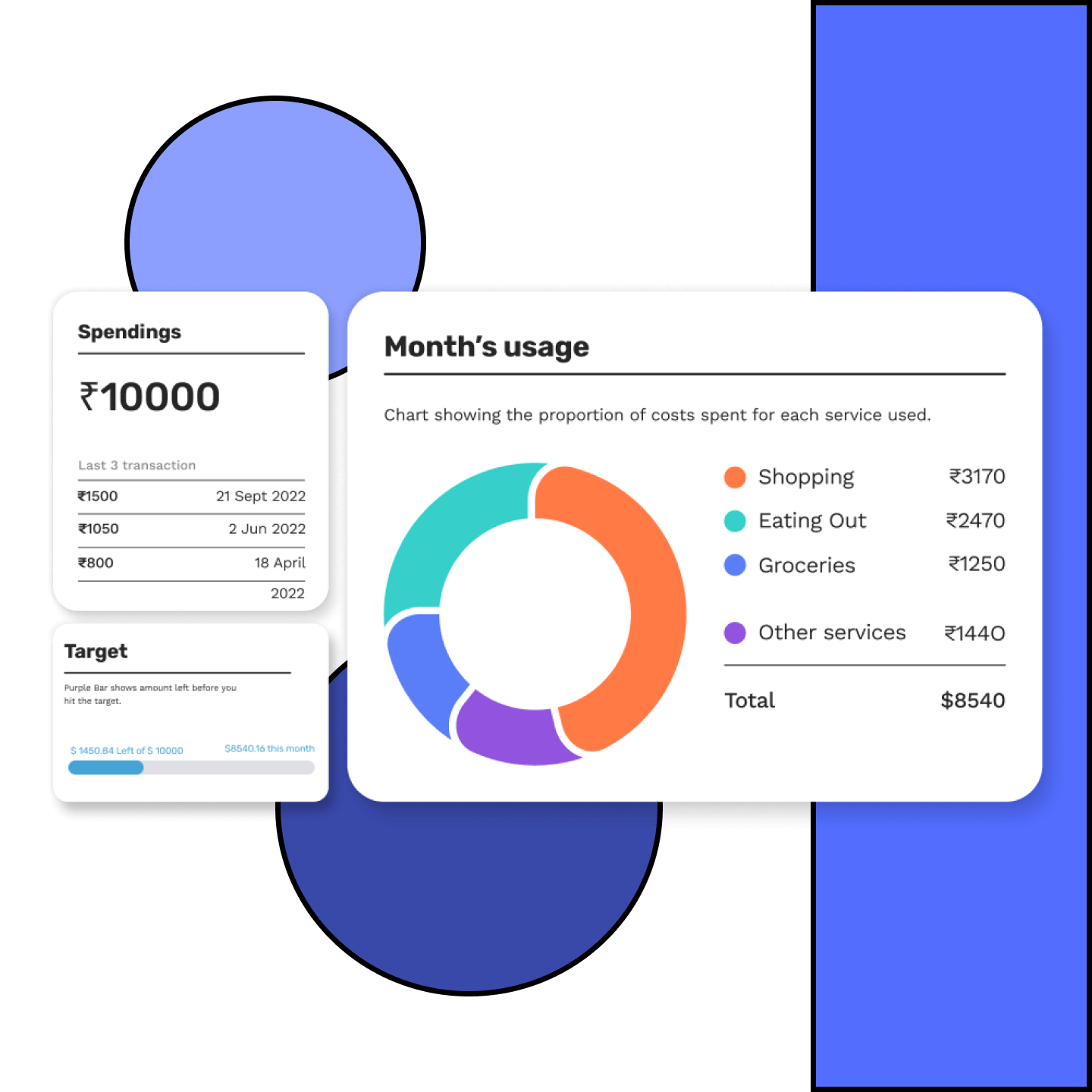

Must-have fintech software features

Our composable software platform empowers you to build fully customised solutions with features like:

Why choose our fintech software development?

Builder.ai saves the time and effort required to build fintech software and launch it on the app stores. Builder.ai has everything you need to run and scale your fintech software.

Save development time

Every no-code mobile app builder has a learning curve. But our fully managed service means you don’t need any technical skills or to mess around with any online coding courses or resources. Instead, we use our AI-powered app builder to deliver your grocery delivery app as efficiently as possible.

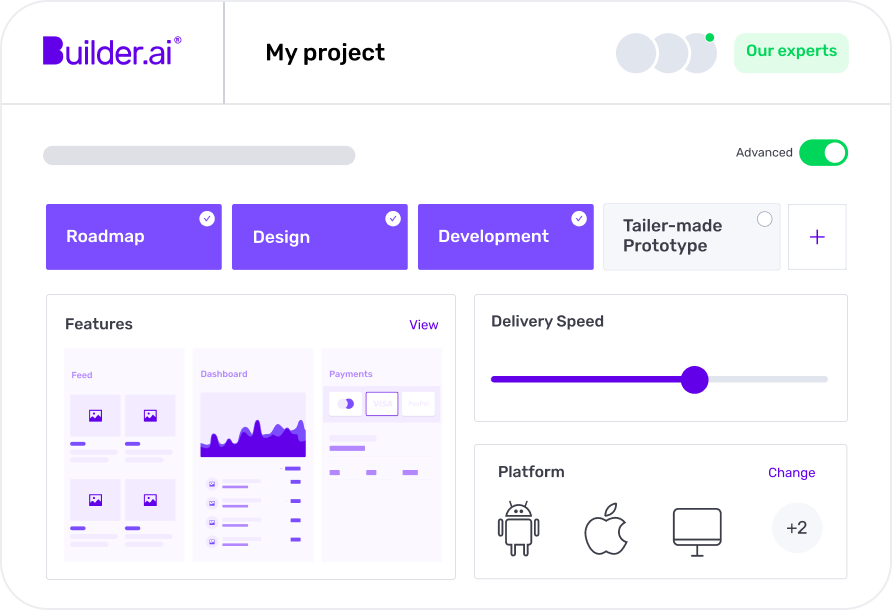

Get total transparency

We charge per feature, laying everything out in a pre-agreed Buildcard before your app’s development even starts. You can interact with experts when you need to and view your project’s progress in your all-in-one project dashboard, Builder Home.

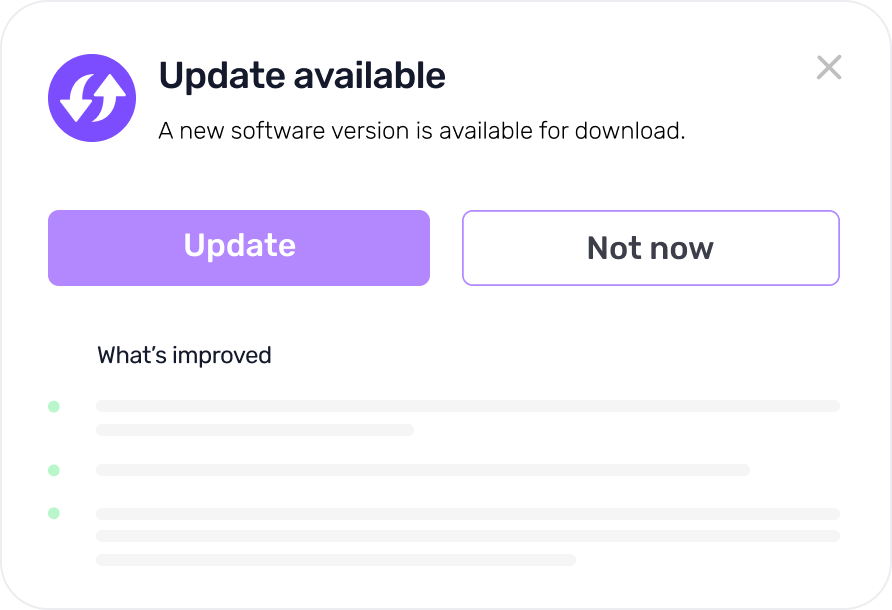

Keep your app fresh

We don’t abandon you as soon as your project is complete. Instead, you get Studio One included for a year, which supports, updates and protects your app. This ensures your app stays bug-free, secure and up-to-date, proactively recognising and solving issues before you or customers notice.

Build universal apps

Say goodbye to compatibility issues as we develop apps that work across all Android and iOS devices. With us, you don’t have the headache of device fragmentation because your app works seamlessly even across multiple OS versions.

Keep your code

Unlike most app-building platforms, there’s no vendor lock-in, meaning you keep your code when you build with us. That means you can easily migrate your app to another provider when your payment plan is complete or scale your app independently.

Access unlimited integrations

Unlock your app’s full potential by adding any integration you like. You’re not restricted to our library, giving you the freedom to integrate with anyone and choose from our large marketplace of third parties.

Advanced technology used to build fintech software

Builder.ai deploys advanced technologies to create cutting-edge fintech software that not only streamlines financial processes but also enhances user experience and security.

Artificial Intelligence

Machine Learning

Cloud computing

API integrations

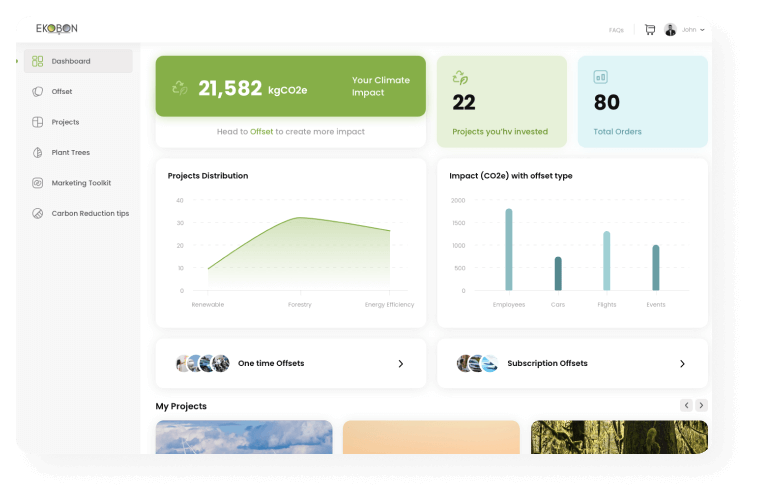

Client success stories

At Builder.ai, we have expertise in assisting businesses increase their profits and scale their operations. Here’s a glimpse into our customer success stories.

Want to see what we’ve built in the fintech industry?

FAQs

What is fintech software development?

Fintech software development empowers you to create software for financial services like banking, payment gateways, insurance and more without extensive coding knowledge. It simplifies the software development process, allowing you to design, configure and personalise your own software without coding.

Can I create a fintech software prototype?

Yes, you can! With our free prototyping tool, Builder Now, you can create a clickable mockup of your idea in under 10 minutes. Experiment with the flow of your software and share it with friends, customers or investors for feedback.

Why should I choose Builder.ai to create my fintech software?

Builder.ai offers a fully managed service, meaning there's zero learning curve as everything technical is done by us. You can create fintech software with custom functionalities with us.

When you work with Builder.ai, your software development costs are finalised before your project starts in a Buildcard, which lists every feature that makes up your software. Because this process is handled up front, you receive a guaranteed pricing plan for your software project, meaning there are no nasty surprises down the line.

What’s more, you keep your code once your two-year payment plan is complete, making it easy to migrate your software to another platform or add custom features to meet emerging business needs.

Finally, we bundle in Studio One, our software support platform, for the first year of your project. It provides a real-time dashboard for visibility into your app’s progress and enables seamless collaboration to help you build the exact app you envision.

How much does it cost to build fintech software?

Builder.ai gives you custom pricing for your fintech software project because we charge per feature. Our AI calculates your software development costs and fits all your features together in a Buildcard before you pay for your fintech software, so there are never any uncalled surprises.

How long does it take to create fintech software?

More complex software takes longer to build.

Smaller apps can be up and running in as little as 2 weeks. Whereas, complex software that needs to do new, complex things and integrate with legacy systems will take longer. Most of our customers are somewhere in between.

But unlike most other developers, you don’t have to cross your fingers about timings. We use AI (which uses every software feature we’ve ever built to spot patterns) to calculate an accurate timeline before you start.

Facebook

Facebook X

X LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram RSS

RSS